Bill headed to governor would remove SC sales taxes from period products

COLUMBIA, S.C. (WCSC) - If you buy gift-wrapping paper, livestock, or even a rollercoaster in South Carolina, you won’t pay any sales tax. You will, however, pay that extra money on a box of tampons.

But that will likely soon change, with the state Senate’s unanimous approval Tuesday of a bipartisan bill to make menstrual or period products tax-exempt in South Carolina, an exemption already in place in more than 30 other states.

“It’s a great victory for women in South Carolina, and it’s a great victory for men, too, because it’s going to save everybody money,” Sen. Katrina Shealy (R-Lexington) said after the vote.

That’s why Shealy, the lead sponsor of the Senate version of the legislation, said this is a tax cut soon headed to the governor’s desk, estimated to save South Carolinians collectively around $7 million a year.

“When people say we don’t cut their taxes, yes we do,” she said.

Advocates note medical products like hearing aids and syringes are tax-exempt, but period products, such as tampons, pads, and menstrual cups, are still taxed, despite being regulated and classified by the US Food and Drug Administration as medical devices.

Under this bill, state and local sales taxes would not be imposed on these items.

“Women and girls, college students, women who don’t have a lot of money to buy food, they don’t get to choose whether or not they need feminine products,” Sen. Margie Bright Matthews (D-Colleton) said.

Supporters said this tax places a disproportionate burden on lower-income South Carolinians and those facing period poverty, who cannot afford these monthly, necessary expenses.

“If you don’t have this essential product, you are either trying to use — I mean, I have heard stories from testimony about socks being used so folks can try to attend school or work, or they physically just have to stay home,” Ashley Lidow with the Women’s Rights and Empowerment Network said. “We do know that access to products is something that would be a barrier to their education and to the workplace.”

Ultimately, this period products bill will head to the governor without a single vote being tallied against it in the male-dominated legislature.

“I don’t think there’s a man in that chamber that wanted to argue tampons with me,” Shealy said.

“We would’ve welcomed it, though,” Bright Matthews added.

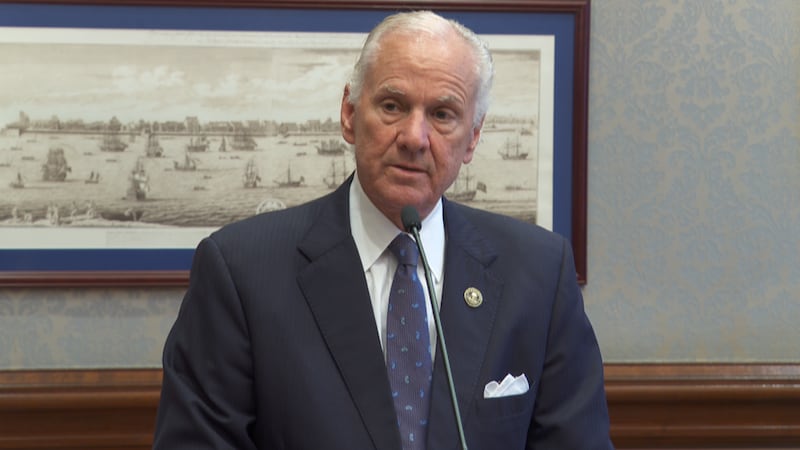

The House already passed this bill, so upon final approval in the Senate on Wednesday and ratification, it will move to the desk of Gov. Henry McMaster.

Shealy said the next item she plans to push to add to South Carolina’s tax-exempt list is diapers.

Copyright 2024 WCSC. All rights reserved.